ETWA 2023 - Day 1

The Energy Trading Week Americas Online Premiere, hosts a discussion with expert speakers from the Energy Trading Week Americas 2023 event last month, giving their insights on the biggest topics, opportunities and challenges that were explored at the in-person conference.

Thomas Lord

Board Member, JP Morgan Center for Commodities

Tim Berrigan

Executive Director & CEO, North American Energy Markets Association (NAEMA)

John Scherb

Sales Director, Fidectus

Mike Prokop

Managing Director, Digital Transformation and Sustainability, The Alliance Risk Group

Howard Walper

CEO Americas, Commodities People

Click on a session title to watch or listen:

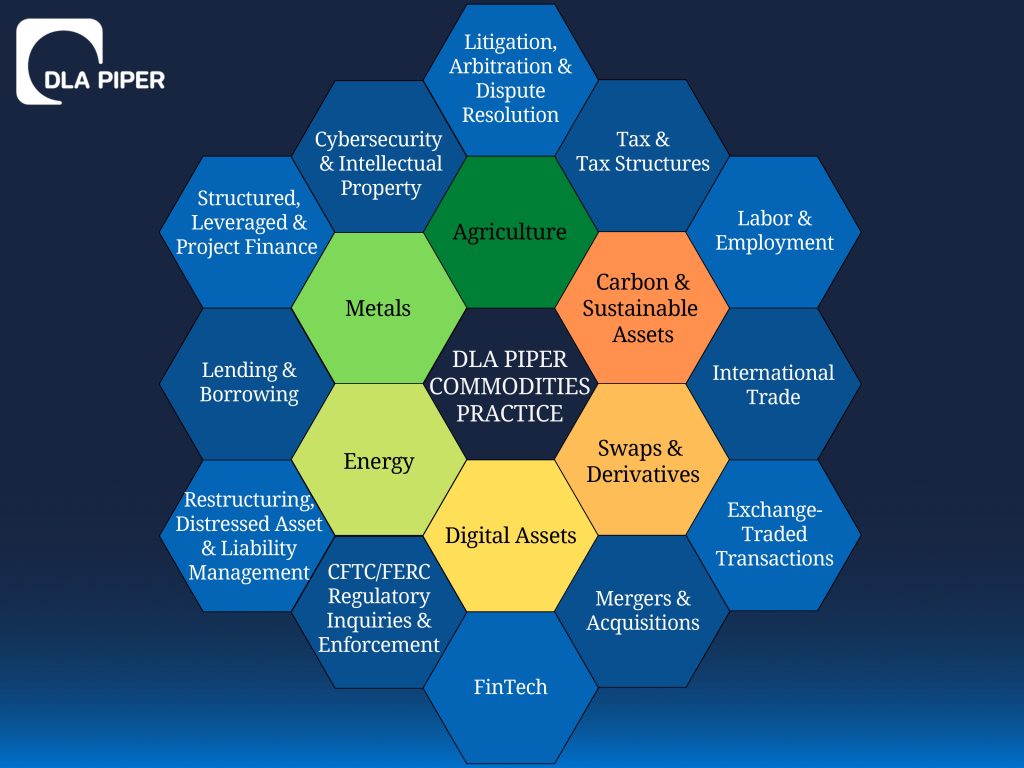

Breakfast Workshop Hosted by DLA Piper

The current state of the international and domestic commodities industry from a political standpoint.

Ambassador P. Michael McKinley, Senior Counselor at The Cohen Group.

Deanna Reitman, Of Counsel, Finance, Energy & Commodities Practice at DLA Piper.

We Are the Champions (executive roundtable): Why the US energy industry has the technical expertise, market savvy and corporate infrastructure to drive practical changes that reduce the industry’s carbon footprint

- Lower carbon vs. the net zero – is there a middle ground?

- Impact of the Inflation Reduction Act on the energy industry?

- Reduction through technology. Can CCU/CCS, hydrogen development and other technology achieve the balance that the fossil fuel industry needs weather the energy transition?

- The role of biofuels, LNG traditional fossil fuels in the energy transition

- Impact of increased biofuel use and EVs on traditional supply/demand, trade flows and pricing mechanisms

Howard Walper, CEO, Americas at Commodities People

Lance Titus, Managing Director at Uniper Global Commodities North America, LLC

Lynda Clemmons, Vice President of Sustainable Solutions and Innovation at NRG Energy

Mark Hughes, Senior Vice President, Commercial at Phillips 66

Thomas Smith, General Counsel and Chief Compliance Officer at Commonwealth LNG

My Future: What will the "trading shop of the future" look like?

- A new era for inflation - can today's systems adapt?

- A world of increasing volatility and extreme weather events

- Has the move to "the cloud" paid off?

- Greater emphasis on environmental metrics and accounting

- The future of “work from home”

Elizabeth Carlson, Chief Sustainability Officer at Tricon Energy

Jacqueline Hallmark, Manager, IT Cyber and Information Security at Just Energy

Keith Farris, Chief Technology Officer at Lucido

Michael Barrett, Partner at Ernst & Young, LLP

Sameer Soleja, Founder and CEO at Molecule Software

Keynote - Take a Walk on the Wild Side: Managing risk in an era of high interest, wild volatility and geopolitical uncertainty (while giving trading groups the leeway they need to succeed)

- Defining your organization’s risk appetite and risk resiliency

- Thoughts on guiding your risk group through challenging market environments

- Overall impact of the high cost of capital and what this means for investment in energy

Stephen Freeman, Chief Risk Officer at JERA Americas

- Impact of inflation and the withdrawal of traditional banks on energy companies

- Increased prioritization of ESG metrics in financing

- Bank failures: An anomaly or a portent?

- Use of trade credit insurance and surety bonds as instruments of collateral over more traditional instruments.

Nithya Venkatesan, Board Member at Committee of Chief Risk Officer

Amir Andani, Chief Risk Officer at Just Energy

Mary Frances Deibert, Vice President – Marketing & ESG at Ironwood Midstream Energy Partners

Pat McKinnon, FVP, Energy Markets and Digital Distribution at Navitas Assurance

Todd Lynady, Advisory Board Member at ITFA

Gimme Shelter: Biggest issues facing credit risk managers today

- Interest rate risk, market uncertainty, inflation

- Liquidity issues and regulatory risk

- Extreme weather events

- Energy transition

Eric Twombly, Credit Risk Manager at Golden Pass LNG

Money Talks (and other macroeconomic musings) - What are today’s economic signals telling us?

- The Treasury yield curve is a barometer of economic health

- Inversions tend to precede recession

- Currently, most dramatic inversion since the 1980s

Sean Britton, Head of Risk and Compliance at Musket

Islam Rizvanoghlu PhD, Senior Data Scientist at NRG

Mark Friedman, Principal Consultant at Aramco Trading Americas

Add it up! - Putting focus back on math in risk management

- Math drives decision making – not feelings

- New methods for calculating volatility and curves

- Advances in risk analysis using Python, AI/Machine Learning

- Risk analysis, decision support

Sid Jacobson, Vice President of Risk Management at Cleco

Chris David, Chief Investment Officer at Buffalo Bayou Resources

Dr. Vince Kaminski, Professor at Rice University, Jones Graduate School of Business

Kevin Kindall, Director of Quantitative Analytics at Hartree Partners

Keynote - So Happy Together: Aligning people, systems, data, and automation

- Project scoping - questions to ask, alliances to build

- The SSS of data: Structure, Security, Scalability

- ETRM as the heart of the trade shop

- Automating processes - practical application of AI, ML and RPA

- New challenges for a new age: carbon tracking, renewables management and more

Mark Higgins, Chief Analytics Officer & Co-Founder at Beacon.io

It’s Fun to Stay at the E…T…R…M

- Build and buy? Or buy and augment?

- Big data and ETRM

- Cloud vs. on premises - exploring pros and cons

- Architectural and interoperability challenges

Dennis Hatchett, CEO at The Vessel Group

Hunter Heldt, ETRM Systems Manager at EnLink

Jose Noyes, IT Director, Trading and Risk at ENGIE

Sameer Soleja, Founder and CEO at Molecule Software

Sterling Carmean, CEO at Triarc Solutions

Thomas Fennesy, Senior ETRM Project Manager at OXY

Domo Arigato, Mr. Roboto: Best practices for robotics and application of Artificial Intelligence in the trade life cycle

- Involving the right people at the right time

- Selecting the task: Where is the “low hanging fruit?”

- Choosing the most appropriate technology

- Mapping out the process

Chris Sass, Host & Founder of Insider's Guide to Energy

Hailey Funk, Manager - Digital Enablement at TC Energy

Jay Bhatty, CEO & Founder at NatGasHub.com

Marc Lefebvre, CTO at ClearDox

Reginald Wade, Futurist & Director at Veritas Total Solutions

Rezoan Ahmed Shuvro PhD, Senior Manager, Data Science at SB Energy

Come Together: Designing data structures to enable AI implementation

Chris Sass, Host & Founder of Insider's Guide to Energy

Cade Burks, Vice Chairman Of The Board at NAESB (North American Energy Standards Board)

Jacqueline Hallmark, Manager, IT Cyber and Information Security at Just Energy

Luke Fangman, Energy Director, Data & AI at Microsoft

Keynote: Money Changes Everything: Catalyzing clean energy markets by seizing U.S. climate stimulus?

- Overview of major U.S. once-in-a-generation packages (Investment and Jobs Act of 2021 and Inflation Reduction Act of 2022)

- catalyzing a diversified portfolio of qualifying clean energy investments

- Tax incentive boosters, state policy matters, and regulatory considerations

- First round of U.S. funding outcomes

- Positioning for second round of funding opportunities

Kimberly Ann Johnston, Founder and CEO at NextGen Energy Partners

All Day and All of the Night: Working the kinks out of 24/7 renewables

- Renewable mix

- Demand response

- Transmission constraints

- Storage

Sarp Ozkan, VP Commercial Product at Enverus

The State of the Art in Renewable Energy Risk Mitigation: A Case Study

The ongoing transition toward renewable energy is leaving power producers, load serving entities, traders, and other electricity market participants more exposed to "intermittency risk" than ever before. Because of their non-dispatchability, wind and solar assets have significantly different financial and risk profiles than their thermal generator forbears. Add to that the tightening negative covariance between generation and price as renewable penetration continues to increase, and you have a recipe for accelerated losses precisely when generation is highest.

So how do you mitigate risk for an asset you can't control? In this talk, we present a case study focused on strategies for hedging solar assets in different regions of the continental United States. We explore optimal sizing of various types of financial hedges (e.g., block vs. shaped) and also optimize the sizing of a battery storage asset co-located with the solar facility, discussing the analytical approach and comparing/contrasting outcomes across strategies and regions. This talk will help participants:

- Learn best practices for hedge and battery sizing relative to renewable generation facilities.

- Understand the key drivers of value and risk for renewable energy assets and contracts.

- Recognize the essential role of analytics in managing today's complex energy portfolios.

Brock Mosovsky, Co-Founder and VP, Analytics at cQuant.io

Metal Health: A spotlight on battery and rare earth metals

- Transition metals overview and applications

- Current market dynamics and trade flows

- Policy, innovation and beyond

Amogh Patil, Market Risk Analyst at Hartree Partners

Rock down to Electric Avenue: And find a huge battery! Trading and risk around battery storage

- Hedging, structuring and tax credit opportunities

- Modelling battery energy storage systems

Timothy Berrigan, Executive Director and CEO at North American Energy Markets Association (NAEMA)

Jazib Hasan, Managing Director at EIG Global Energy Partners

Nitin Kumar Sinha, Head of Risk at AES Clean Energy

William "Bull" Flaherty II, CEO at Eligius Power

The Times They Are A-Changing (be prepared!): Managing risk around renewable energy assets

- How is the energy transition changing risk management requirements?

- Complexities of Power Purchase Agreements (PPAs)

- Tracking positions in a diverse renewables portfolio

- Tactics for hedging renewables

Timothy Berrigan, Executive Director and CEO at North American Energy Markets Association (NAEMA)

Brock Mosovsky, Co-Founder and VP, Analytics at cQuant.io

Bryan Bonner, Managing Director, Commodities Markets at Ernst & Young, LLP

Erick Marquardt de Araujo, Head of Renewable Portfolio Management at ENGIE

I've Got the Power: PPAs and vPPAs

- How corporations are using PPAs to reduce their carbon footprint

- PPA market conditions – risking prices, shrinking availability

- Challenges to renewable project development (supply chain, labor force, cost)

- How might the IRA help?

Tom Lord, Board Member at JP Morgan Center for Commodities

Fabiana Pasquot Polido, CRO - Chief Revenue Officer - Renewables at Omega Renewables

Mariana Fulan, Renewable Energy Origination Manager at Omega Energia

Pat McKinnon, FVP, Energy Markets and Digital Distribution at Navitas Assurance

Terry Embury, VP, Head of Trading and Market Operations at AES Clean Energy

ETWA 2023 - Day 2

Click on a session title to watch or listen:

Somebody's Watching Me: CFTC oversight of the VCM

(Fireside Chat)

Tom Lord, Board Member at JP Morgan Center for Commodities

Devin Cain, Trial Attorney at Commodity Futures Trading Commission (CFTC)

Under Pressure – Carbon capture sequestration/utilization

- Is CCU under-invested?

- What does CCU/S mean for traditional fossil fuels producers?

- CCU and bio-based fuels – using CO2 for use in synthetic fuels?

- Is CCUS the only path to a completely carbon neutral energy industry?

- Major projects in development

Howard Walper, CEO, Americas at Commodities People

Macgill James, Director CO2 Supply at TES

Renee Pirrong, Vice President of Business Development at HIF Global

Upendra Prasad, Facilities Engineer at Marathon Oil

Jumping Jack Flash, It’s a Gas Gas Gas (And so is hydrogen!): Is Houston poised to be the nation’s hydrogen hub? Exploring the challenges and opportunities in Houston’s burgeoning industry

Michael Prokop, Managing Director, Digital Transformation and Sustainability at The Alliance Risk Group

Alan Hayes, Head of Energy Transition Pricing at Platts, S&P Global Commodity Insights

Brett Perlman, CEO at Center for Houston's Future

David Maher, Clean Hydrogen & Carbon Capture, Americas Large Projects at Linde

Women's Breakfast Briefing: It’s a Commodity World – Aligning, Navigating and Allocating Resources

- Navigating Regulatory Landscape in the New Era

- Current Environment and Outlook of the Commodity Market

- Nuclear Energy – Design & Implementation of Nuclear Plants

- Trends and M&A Activity in the Energy Transition Space

Nina Skinner, Partner at Blank Rome

Kara Pelecky, Chief Information Officer at ABS

Lidiya Deanne, Director (Stout) and President Elect (WEN) at Stout & President Elect for WEN

Lina Chambers, General Counsel at Novum Energy

Volunteers of America Pt. 1: Credit quality, standardization, regulation

- Credit quality

- Efforts at standardization

- Progress towards international program/s

Alan Hayes, Head of Energy Transition Pricing at Platts, S&P Global Commodity Insights

Chelsea Bryant, Managing Director, Trading, Global Markets at BMO Radicle

Devin Cain, Trial Attorney at Commodity Futures Trading Commission (CFTC)

Erika Anderson, Chief Legal Officer at RenewWest

Farhan Ahmed, Chief Program Management Officer at Verra

Volunteers of America PT 2: Voluntary Offset Market Dynamics

- Supply and demand outlook for carbon credits

- Pricing carbon

- International trading

Chelsea Bryant, Managing Director, Trading, Global Markets at BMO Radicle

Alan Hayes, Head of Energy Transition Pricing at Platts, S&P Global Commodity Insights

Benoit Tramontini, Senior Trader – Environmental Products at Act Commodities

James Row, Founder & Managing Partner at Entoro

Eye in the Sky: Trade Surveillance and Compliance

- Keeping up with technology

- Impact of recent CFTC enforcements –

- Challenges of managing compliance in a work-from-home environment

- SEC and FERC initiatives

Jamila Piracci, Principal at Roos Innovations

Matthew Moore, Associate Director, Americas Lead for Commodity Surveillance at Macquarie Group

Swati Sachdev, Senior Compliance Advisor at Hartree Partners

Toby Kearn, Chief Executive Officer at K3 by Broadpeak

We are the World: Navigating multiple regulatory regimes in international trading

- Comparative look at the regulatory environments in the EU, UK and USA – what does an international trader need to know?

- EMIR Refit – How will this impact US trading companies

- What's on the horizon

Tom Lord, Board Member at JP Morgan Center for Commodities

Diane Zeiler, Head of Compliance - US at Hartree Partners

Rahim Kabani, Director at Essentia Advisory Partners

Sulmaan Lateef, Associate Director Risk Management Group, Compliance at Macquarie